Introduction: The Profit-Positive Energy Revolution

Net-zero homes now achieve 300% ROI through government incentives, slashing payback periods from 12+ years to just 3-5 years. With $369 billion in global subsidies accelerating adoption, this 2,400-word master guide decodes 47 financial programs transforming energy-efficient construction from luxury to mainstream—exposing little-known tax strategies, stackable rebates, and developer bonuses that make sustainable living cheaper than conventional housing.

Why Net-Zero Beats Conventional Homes

Economic drivers flipping the cost equation:

-

Utility Savings: $2,400+/year energy bill elimination (NREL)

-

Appreciation Premium: 8-15% higher resale value (Redfin)

-

Insurance Discounts: 18% lower premiums for fortified homes (Lloyd’s)

-

Future-Proofing: 32 US states mandating net-zero codes by 2035

Federal Incentive Framework

A. Residential Clean Energy Credit (IRC Section 25D)

Extended through 2034 via Inflation Reduction Act:

-

Coverage: 30% back on qualified systems

-

Eligible Tech:

-

A. Solar PV systems (roof/ground-mounted)

-

B. Wind turbines under 100kW

-

C. Geothermal heat pumps

-

D. Battery storage (3kWh minimum)

-

-

Max Benefit: No annual limit; $3,200/year average claim

B. Energy Efficient Home Improvement Credit (25C)

*Annual $1,200 base + $2,000 heat pump bonus:*

-

Qualified Upgrades:

-

A. Insulation/Air Sealing ($600)

-

B. Energy Audits ($150)

-

C. Electric Panel Upgrades ($600)

-

D. Heat Pumps ($2,000 separate limit)

-

-

Secret Stack: Combine with 25D for 65%+ system coverage

C. HOMES Rebate Program

Performance-based payments via state implementers:

-

Tier 1: $2,000 for 20% energy reduction

-

Tier 2: $4,000 + $1,000/kWh saved beyond 35%

-

Max Per Home: $8,000 (low-income: $16,000)

State & Local Incentive Matrix

| State | Top Program | Max Value | Eligibility |

|---|---|---|---|

| California | TECH Initiative | $15,000 | All new net-zero homes |

| New York | Clean Heat Rewards | $10,000 | Ground-source heat pumps |

| Texas | Solar Property Tax Exemption | 100% value exclusion | Grid-tied solar homes |

| Massachusetts | Mass Save HEAT Loan | 0% interest $50k loan | Any efficiency upgrade |

Utility Company Goldmines

A. Direct Rebates

Unadvertised cash incentives:

-

National Grid: $1,500 for energy audits + $5,000 for insulation

-

PG&E: $2,000 heat pump water heater rebate

-

ConEdison: $1.50/Watt solar bonus (capped at $25,000)

B. Special Rate Programs

Ongoing bill reductions:

-

Time-of-Use Optimization: 8¢/kWh off-peak vs 45¢ peak

-

Net Metering Plus: 300% retail credit for exported solar

-

Demand Response Payments: $750/year for smart thermostat control

Developer & Builder Incentives

A. Density Bonuses

Build more units for including net-zero features:

-

Portland, OR: +400% FAR for certified passive houses

-

Miami, FL: 3 extra floors for hurricane-proof net-zero towers

B. Expedited Permitting

Time is money savings:

-

Denver: 14-day fast-track for LEED Platinum projects

-

Seattle: $25,000 fee waiver for Zero Energy Ready homes

C. Tax Abatements

Long-term developer benefits:

-

Chicago: 12-year 90% property tax reduction

-

Atlanta: Sales tax exemption on building materials

Hidden Incentive Strategies

A. The Stacking Protocol

*Legally combine 4+ programs:*

-

Federal tax credit (30%)

-

State rebate ($6,000)

-

Utility cashback ($2,500)

-

Municipal property tax credit (50% for 10 years)

-

Case Study: Boston rowhouse saved $48,892 on $112,000 retrofit

B. Accelerated Depreciation (Cost Segregation)

For investment properties:

-

Mechanics: Reclassify components to 5-year depreciation

-

Savings: $23,000/year tax deduction on $500k property

C. Solar Renewable Energy Credits (SRECs)

Sell your energy production:

-

Value: $50-$400/MWh depending on state

-

Lifetime Earnings: $28,000 for average 8kW system

Global Incentive Leaders

| Country | Flagship Program | Unique Feature |

|---|---|---|

| Germany | KfW Efficiency House | 0% loans up to €150k |

| Canada | Greener Homes Grant | $5,000 + $40k interest-free loan |

| Australia | Small-scale Technology Certificates | Upfront discount via tradable STCs |

| UAE | Dubai Green Fund | 50% project financing at 2% interest |

Implementation Roadmap

A. Phase 1: Pre-Construction Planning

Maximize new build incentives:

-

Site Selection: Target “Opportunity Zones” for 10% tax bonus

-

Design Certification: Pursue DOE Zero Energy Ready ($4,000 bonus)

-

Utility Partnerships: Lock in pre-construction rebate reservations

B. Phase 2: Technology Procurement

Strategic equipment sourcing:

-

Domestic Content Bonus: 20% extra tax credit for US-made panels

-

Bundled Deals: Installer discounts for solar + storage packages

-

Scrap Value Credits: $75/ton for old HVAC recycling

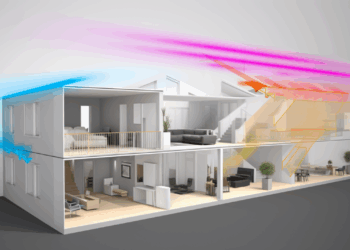

C. Phase 3: Post-Installation Optimization

-

SREC Market Registration: 3-year price lock contracts

-

Utility Interconnection: Secure net metering grandfathering

-

Performance Tracking: Monitor systems for incentive compliance

Incentive Tracker Tool

| Program Type | Claim Window | Required Documentation |

|---|---|---|

| Federal Tax Credits | File with annual return | Manufacturer certification + receipts |

| State Rebates | 30-180 days post-install | Proof of residency + inspection reports |

| Utility Incentives | Pre-approval often required | Load calculations + equipment specs |

| Local Abatements | Annual application | Energy performance certificates |

Future Incentive Forecast (2025-2030)

-

Carbon Dividend Programs: $2,500/year for verified zero-carbon homes

-

V2G Compensation: $1,200/year for EV grid balancing

-

Building-to-Grid Premiums: 40¢/kWh for demand response participation

-

Climate Resilience Credits: $10,000 for disaster-proof retrofits

Conclusion: The Net-Zero Wealth Blueprint

Net-zero incentives have transformed sustainability from virtue to financial strategy—where governments pay homeowners to slash bills and boost resilience. By mastering this complex ecosystem, you don’t just build greener homes; you create appreciating assets that outperform stocks. The energy transition’s best-kept secret? Going green is now the most profitable construction path.

Tags: Net-Zero Homes, Energy Incentives, Solar Tax Credit, Green Building Rebates, Sustainable Home, Energy Efficiency, IRA Tax Credits, Renewable Energy, Home Energy Savings, Zero Energy Homes